boulder co sales tax rate 2020

Determining the increase in base revenue can be. The Colorado state sales tax rate is currently.

Colorado Income Tax Calculator Smartasset

The December 2020 total local sales tax rate was also 4985.

. CO Sales Tax Rate. There is no applicable city tax. Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes.

The minimum combined 2022 sales tax rate for Boulder County Colorado is. The 2020 Boulder County sales and use tax rate is 0985. Economic Nexus requires remote sellers with no physical nexus in Boulder to collect and remit sales tax on retail sales of tangible personal property commodities andor services.

See the Sales Tax Filing. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

Boulder in Colorado has a tax rate of 885 for 2023 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. Fountain CO Sales Tax Rate. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division.

The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local. Fast Easy Tax Solutions.

The December 2020 total local sales tax rate was 8845. The December 2020 total local sales tax rate was 8845. The current total local sales tax rate in Boulder County CO is 4985.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and. As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020.

The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs. Sales Tax Rates Colorado information registration support. Englewood CO Sales Tax Rate.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a. Sales tax is due on all retail transactions. You may e-file for multiple locations using approved XML software or request to file by spreadsheet both of which are uploaded in Revenue Online.

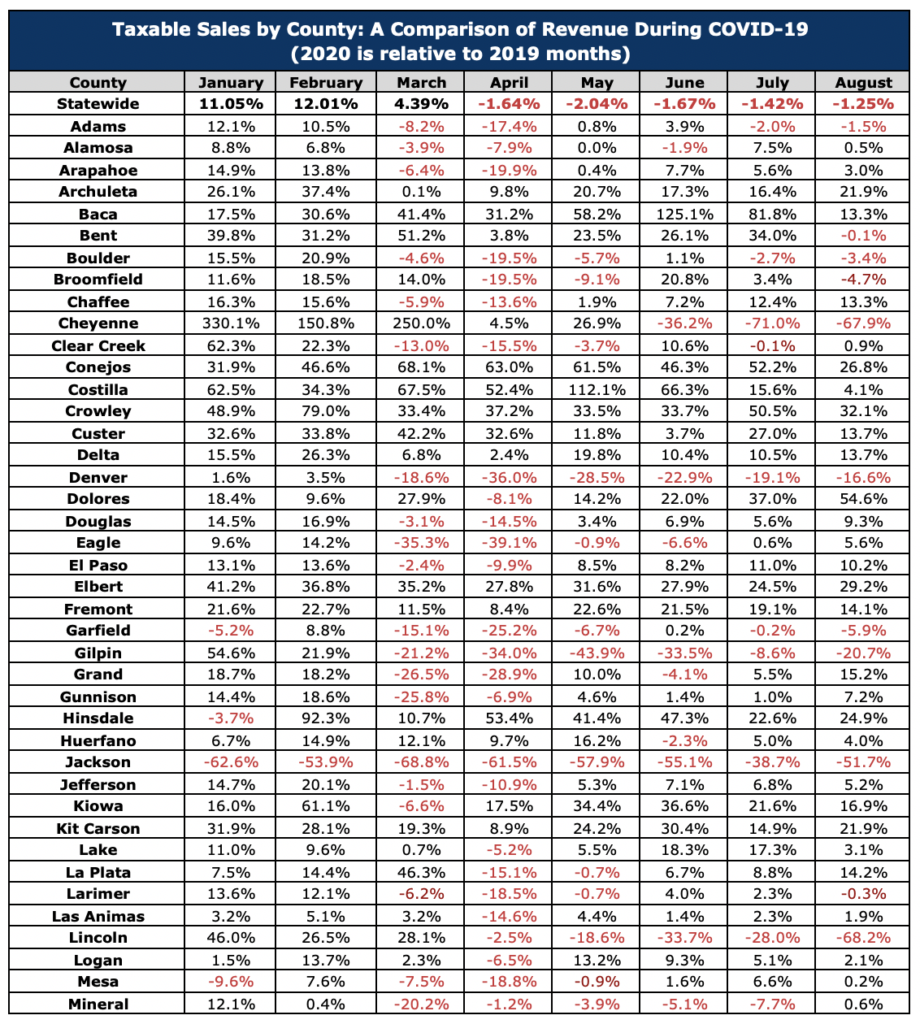

The current total local sales tax rate in Boulder CO is 4985. 2055 lower than the maximum sales tax in CO. The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020.

This table shows the total sales tax rates for all cities and towns in. The 2020 Boulder County sales and use tax rate is 0985. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The current total local sales tax rate in Boulder CO is 4985. The ESD tax is. You can print a 9 sales tax table here.

This increment was renewed in 2019. The 2020 Boulder County sales and use tax rate is 0985. The amounts in the.

Fort Collins CO Sales Tax Rate. The minimum combined 2022 sales tax rate for Boulder Colorado is. The Colorado sales tax rate is currently.

In 2015 30 percent was approved for community culture and safety projects this amount was renewed in 2017 and ends in 2021. Grand Junction CO Sales Tax Rate. You can find more tax rates and allowances for Boulder and Colorado in the 2023 Colorado Tax Tables.

Colorado Income Tax Rate And Brackets 2019

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado S Love Affair With Open Space Started With A Boulder Tax Experiment Colorado Public Radio

Nevada 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

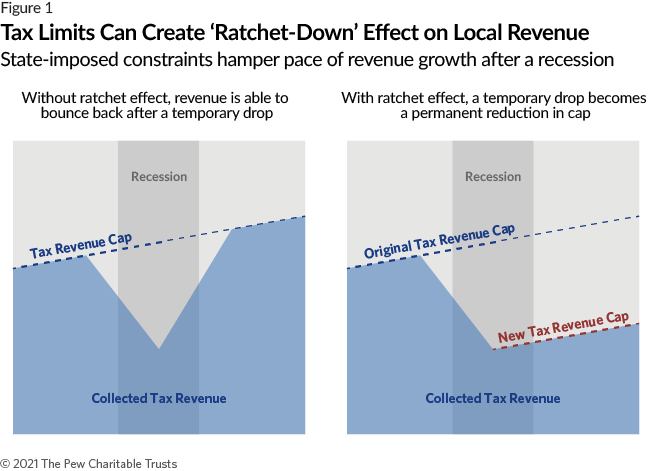

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

2020 Form Co Dr 1002 Fill Online Printable Fillable Blank Pdffiller

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Economic Recovery Takes Hold In Boulder County But Headwinds Linger

An Essential Guide To Voting In Boulder County S Midterm Election

How Do State And Local Soda Taxes Work Tax Policy Center

How I M Voting In The 2022 Boulder Colorado Elections And Voter Guide Boulder Colorado Voter Guide Eric Budd

Small Local Businesses Survive The Pandemic The Bold Cu

Colorado Progressives Have A New Target In Their Pursuit Of A Tax Overhaul The Rich Here S Why The Colorado Sun

Colorado Aims To Simplify Local Sales Tax Collection For Remote Sellers